On March 2, 2018, BGR released “On The Ballot: St. Tammany Parish Sales Tax Renewals, March 24, 2018”. On March 24, St. Tammany voters will decide whether to renew two separate parish wide sales taxes. The report and a one-page summary of each renewal proposition are available at bgr.org.

Proposition No. 1: Justice Center Tax Renewal

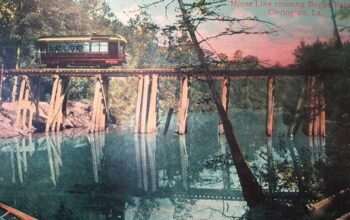

Proposition No. 1 would renew the sales tax dedicated to the Justice Center facilities, which include the courthouse in Covington and an annex in Slidell. St. Tammany Parish has levied the tax for 20 years at a rate of 0.25%. Voter renewal would extend the tax for another 10 years at a reduced rate of 0.20%. It would also expand the dedicated purposes to direct at least 10% of tax revenue to the 22nd Judicial District Specialty Courts. This will be the Parish’s third attempt to renew the tax. If voters reject it again, the tax will expire March 31, 2018.

BGR Position on Justice Center Tax Renewal: Against Given the Parish’s small amount of unrestricted revenue, the Parish needs a dedicated funding source for the Justice Center facilities. However, the Parish has not clearly demonstrated to voters how much revenue is required to meet the Justice Center’s future operating and capital needs. In addition, the proposition dedicates a portion of revenue to the Specialty Courts which, despite any benefits they provide to the community and the local criminal justice system, currently are self-sustaining and are not a mandatory function of the district court. Voters should let this tax expire and require the Parish to come back with a tax proposal it can prove to be appropriately scaled based on a clear plan for future spending. The Justice Center is funded through 2018 and has enough funding without the renewal to postpone further budget cuts this year. The Parish should present voters with its new tax proposal later this year on the November or December 2018 ballots.

Proposition No. 2: Jail Tax Renewal

Proposition No. 2 would renew a sales tax dedicated to the parish jail. St. Tammany Parish has levied the tax for 20 years at a rate of 0.25%. Voter renewal would extend the tax for another 10 years at a reduced rate of 0.20%. This will be the Parish’s third attempt to renew the tax. If voters reject it again, the tax will expire March 31, 2018.

BGR Position on Jail Tax Renewal: For

The Jail Tax provides significant revenue for the Parish’s and Sheriff’s obligations to support the parish jail. Renewal of the tax would help secure the jail’s future for another 10 years at a slightly reduced cost to taxpayers. Loss of the tax would result in new budget cuts that would reduce Parish services in other areas and potentially undermine jail operations and the quality of law enforcement.

BGR notes that renewing the tax at the proposed rate would leave some jail costs unfunded. Based on the sheriff’s projections, the jail will need additional funding to offset future deficits and make necessary capital investments in jail facilities. To better inform the public on the jail’s financial condition, the Parish or the Sheriff should post online the jail accountability reports.

BGR is a private, nonprofit, independent research organization. Since its founding in 1932, it has been dedicated to informed public policy-making and the effective use of public resources in the Greater New Orleans area. For more information, call 525-4152 or visit BGR online at bgr.org.